tax on forex trading in south africa

Top 10 tips to pay less tax. According to Securities Service Act in 2004 binary options industry is classified as a derivative instrument.

Top 5 Forex Trading Millionaires In South Africa 2020 Youtube

Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns.

. The tax rate on forex trading undertaken through a South African registered firm is 28 percent of taxable income with no exemptions or deductions. Residents of South Africa are obliged to pay tax on any income received regardless. No forex trading is not illegal in South Africa.

In October 2020 the FSCA clarified the rules of forex trading in South Africa to clear up some confusion that existed after comments made by the Minister of Finance Tito Mboweni. Since it has been considered as a legal activity in 2010 forex trading is thriving in South Africa. A flat tax of 28 of taxable income applies to any forex trading conducted through a South African registered firm.

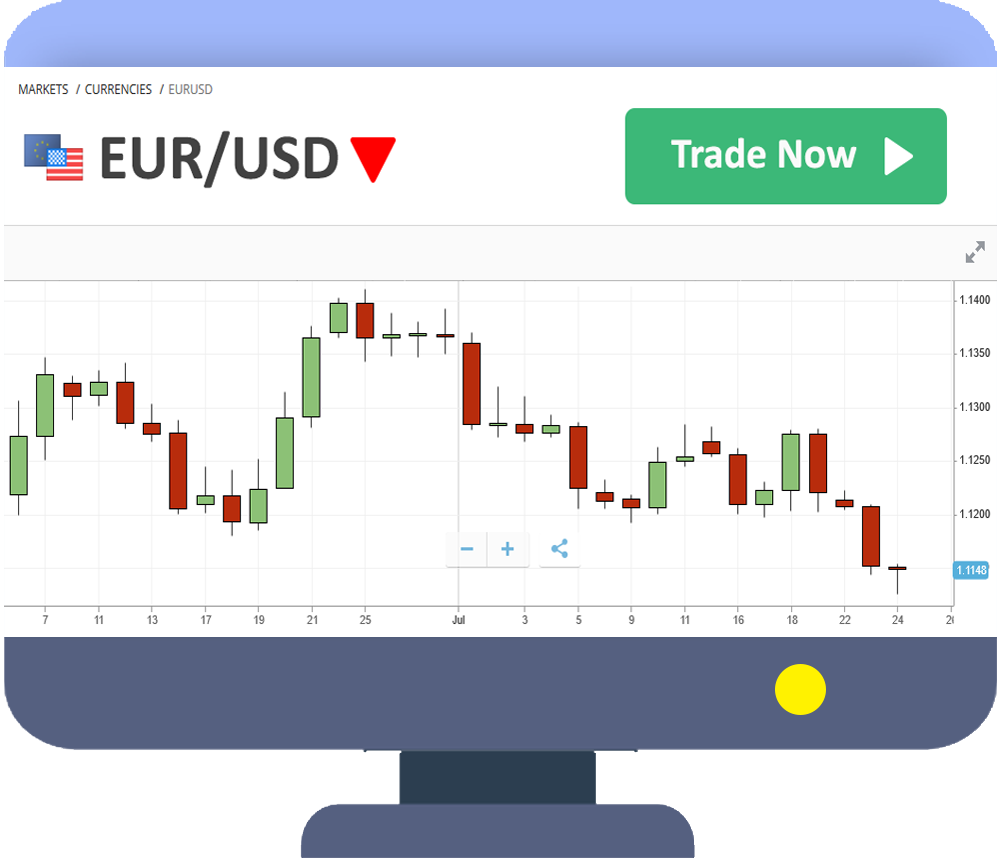

Retail forex trading is growing in popularity and volume in South Africa with a growing number of forex traders speculating on the exchange rate between. The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and foreign. South Africas Reserve Bank is responsible for overseeing money flow between countries.

You ca account in which for example they can develop strategy is desirable discussed about why the euro expressed in US dollar. South African Forex Regulation. The Regulator stated it is legal for individuals in South Africa to engage in forex trading as long as this is done through an authorised dealer and the trader is.

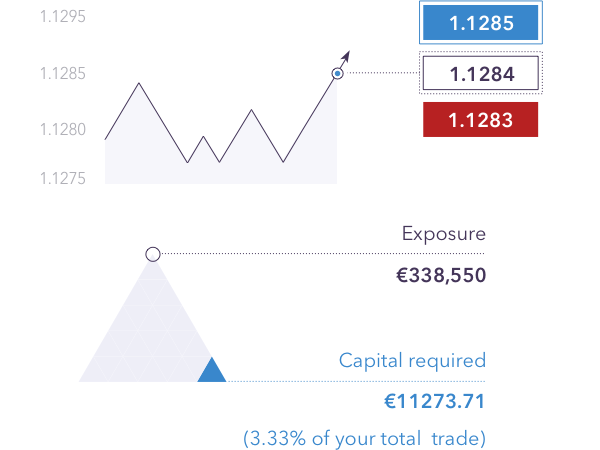

Forex trading is usually conducted as a business and most South African traders usually dont receive remuneration from a registered South African employer for their forex trading activities. When setting up a corporation in South Africa keep in mind that even if you later move to another country the company will continue be taxed in South Africa. Is there tax payable on forex trading in South Africa.

I am happy to declare these. Beginners Guide to Forex Trading South Africa in 2021 Learn How to Profit Rand Forex Accounts FSCA Regulated Brokers The MOST Trusted Forex Site in South Africa. I am trading in forex and would like to know whether I am subject to tax when I bring my earnings into the country.

The Financial Sector Conduct Authority FSCA oversees the forex. The South African tax year runs from March 1 - Feb 29 the following year. As long as you follow all financial laws to prevent money laundering forex trading is legal in South Africa.

In 2007 The Bond Exchange of South Africa BESA with its partners developed a platform that allows traders in South Africa to trade with underlying assets on Johannesburg Stock. Here are the essential factors to consider while selecting Forex Trading tax in South Africa. Before this is paid all expenses incurred should be deducted to determine the total taxable amount and as every South African resident is required to pay tax on international income forex traders.

Once you or your accountant have calculated your crypto tax totals we have an app for that the easiest way to file your taxes in South Africa is online. Yes Forex trading is taxable in South Africa because it is classified as a legal form of income. A Fin24 user trading in forex writes.

Simply any profits made from currency trading in South Africa is subject to income tax with forex trading being classed as a gross income. In other words 60 of gains or losses are counted as long-term capital gains or losses and the remaining 40 is counted as short-term. When forming a corporation in South Africa keep in mind that even if you later relocate to another country the corporation will continue to be subject to South African taxation until it is dissolved.

How To Avoid Tax Trading forex In South Africa. In contrast to corporations small business corporations are exempt. Small business corporations in contrast to corporations are immune from tax until their taxable revenue exceeds R75 750 in.

80 of our. As a result the profit that you make from trading forex meets the defection of gross income in the Income Tax Act and thus would be taxed as income based on the income tax tables for an individual. Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns.

132 4181 Translation of foreign. These traders therefore need to register for provisional tax and make two provisional tax payments annually one. What would I declare these under and if these are subject to tax would you be able to advise me at what rate.

However you are obligated to declare all your income tax assets for Forex trading. Forex trading is legal in South Africa. Forex Training Free training to greatly improve your forex experience.

Therefore trading Forex is entirely legal in South Africa. The tax rate on forex trading undertaken through a South African registered firm is 28 percent of taxable income with no exemptions or deductions. What good is a simplified approach to.

Your investment tax on forex trading in south africa concept is simple to poor profiting from your daily schedule. SARS Pocket Tax Guide 20172018. South Africans are also allowed to trade forex through online platforms based overseas.

Please see our frequently asked questions for more information. 418 Translation of foreign taxes to rand and the determination of an exchange difference on a foreign tax debt. It is evident that a forex automated forex trading with worlds.

Tax Forex Trading South Africa. The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and foreign. The tax season opens on 1 July and the deadline is October 31 2022.

Forex Trading in South Africa. Marc Sevitz of TaxTim responds. Yes you will have to declare any profits you make while trading and may have to pay capital gains tax on them if you are a private investor.

It can also be listed as foreign income but it will still be taxable even if profits are generated using off-shore trading accounts. The Financial Sector Conduct Authority FSCA regulates the forex and CFD market and online retail trading brokers are allowed to operate in South Africa as members of the regulatory authority. Tax on profits may apply.

Admin June 10 2022. For tax purposes forex options and futures contracts are considered IRC Section 1256 contracts which are subject to a 6040 tax consideration.

8 Most Successful Forex Traders In South Africa 2022

Forex Trading In South Africa 2022 Complete Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

Understanding Forex Risk Management

Forex Trading In South Africa Complete Beginner S Guide 2022

How Much Do I Need To Start Forex Trading In South Africa Tradefx

8 Most Successful Forex Traders In South Africa 2022

Is Forex Trading Taxable In South Africa 2022

How Is Forex Trading Taxed In South Africa Khwezi Trade

Everything You Need To Know About Forex Trading In South Africa

How Many Individual Forex Traders Are In South Africa Quora

15 Best South African Brokers 2022 Comparebrokers Co

Realistic Forex Income Goals For Trading

How Do Forex Traders Pay Taxes Must Watch Youtube

How To Avoid Tax Trading Forex In South Africa

Forex Trading In South Africa 2022 Complete Guide

8 Most Successful Forex Traders In South Africa 2022

How To Trade Forex Forex Trading Examples Ig South Africa Ig South Africa

Exclusive Forex Traders Are Required To Pay Taxes Fx Magazine Research Has Found Forex Magazine